Source:Geografía Infinita

The Hispanic Monarchy was for 300 years uninterruptedly the largest mint in the world. The real de a ocho was constituted as the universal currency of commerce during that time. The longest duration ever for a reference currency.

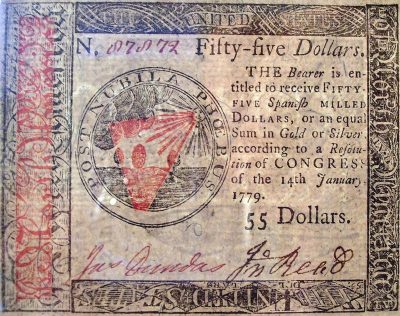

In addition, the model of the real de a ocho was copied for the emergence of the US dollar, the Canadian dollar, the Chinese yuan, the Japanese yen, the pesos of the American independent republics, the Philippine peso, and many other currencies around the world.

The so-called real de a ocho, Spanish dollar, “hard” or simply hard peso, minted since the mid-16th century, was the most important currency in the world until well into the 19th century. It served as a currency on which to reference the circulating currencies of the other states of the time and to be able to participate in the trade of the five continents.

The real of eight was the currency of the Spanish Empire and it far outlived it. In the United States, it was the legal currency until no less than 1857. But in addition, the reales de a ocho were the first universal currency, since they not only circulated throughout Europe and America but also in Asia.

Thanks to its great prestige, it was the main value used for large payments and financial operations in which, for the first time, the various continents were going to be involved. The quality of its silver, obtained in the American mines and the enormous volume with which it was minted, made this coin the most accepted in all international markets during the Modern Age.

Conception and operation of the real de a ocho

The real de a ocho was a silver coin that the Spanish Empire minted after the monetary reform of the Catholic Monarchs in 1497 (in accordance to the Pragmatic of Medina del Campo of 1497) with a weight of 27.468 grams and a purity of 0, 93055%, which contained 25.560 grams of pure silver.

The coins had a value of eight reales (8 reales and 272 maravedís. 1 real de a ocho = 1 hard peso. 2 reales de a ocho = 1 escudo). The real de a ocho is on a duodecimal basis adjusted to the weight pattern of the Cologne frame of 233.85 grams of weight. Together with the ounce, a gold coin, it responds to the bimetallic system (real de a ocho – ounce) of the 16th century of the Spanish Monarchy, introduced by Carlos I and spread by Felipe II in all its states.

8 silver reales with the coat of arms of the Catholic Monarchs, minted in Seville. Undated but after 1497

The international currencies of previous times, those issued by the Italian republics, were replaced by the Spanish reales de a ocho. Thus, the displacement of the economic preeminence from the Mediterranean, which ceased to be the axis of trade and with it of the monetary world took place.

As the Spanish crown was expanding its possessions overseas, and especially after the conquest of Peru and Mexico, the reales de a ocho began to be minted in America as well.

Carlos I, in 1517, created the Audiencia of Mexico or New Spain, and on May 11, 1535, the Casa de Moneda de New Spain was established by Royal Decree, the oldest mint in America (the metal coming from the Mexican deposits Zacatecas and Guanajuato).

The wealth of the Potosí mines gave rise to the birth of the mint of the same name and the birth of the city between 1544 and 1554. There were the very rich silver mines, practically a massive mountain of this material, the largest silver deposit that has ever existed.

During the next sixty years, Potosí’s population increased to 160,000, the same as London or Paris. The Cerro Rico de Potosí may have produced 60% of all the silver mined in the world during the second half of the 16th century. Its veins were incredibly rich.

In addition to these naturally generous deposits, a number of new production technologies – most famously the mercury amalgam or patios method – came together to give Hispanic American mines the lowest production costs for silver. This phenomenon on the supply side was particularly fortuitous, as it coincided chronologically with the extraordinary increase in the value of silver caused on the Chinese demand side.

Panoramic view of the Bolivian town of Potosí. In the background, Cerro Rico, considered to be the richest silver vein in the Empire, and probably in the world.

The combination of low production costs on the supply side in Hispanic America and the Chinese demand side rise in the value of silver in Asia probably generated the most spectacular mining boom in human history.

Dissemination through the world of the real de a ocho

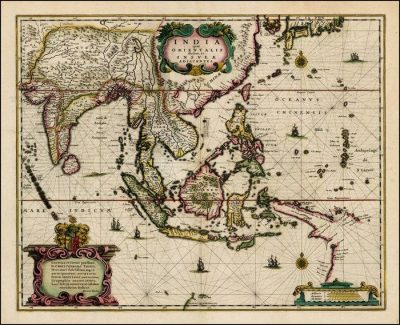

For more than three centuries the real de a ocho was not only international currency, but was also the main export product in the northern states of the New World, the Antilles, the Philippines, China, Japan, Indochina, Korea, India, and the Malay Straits; in addition to using the real of eight in commercial transactions with the Orient, England, and France.

Such was its diffusion that all European merchants who acquired merchandise in the East had to necessarily satisfy their acquisition in Spanish silver currency, so that both the Portuguese caravels and later the ships of the Dutch, British, French or Danish companies carried the real de a ocho as an exchange currency, and this continued to occur well into the nineteenth century.

Dutch map of the East Indies from 1635

Spanish currency was also circulating in the British Thirteen Colonies of North America long before they declared their independence. Due to the difficulty of the navigations, only few sterling pounds reached the colonies and it was much easier to stock up on the nearby and reputable reales de a ocho minted in Mexico than with English pounds.

In the Thirteen Colonies, Spanish currency circulated normally and was known first as “Spanish thaler”, later becoming “Spanish daller”, and later “Spanish dollar”. The reales de a ocho were known as “taleros” because of their resemblance to the sturdy Austrian currency “thaler”.

Silver colonnade, the inspiration for the creation of the dollar symbol, $. This design belongs to the reign of Fernando VI, minted at the mint of Mexico.

The reales de a ocho had a face value of eight reales in Spain and its overseas territories, but the need for fractional currency often caused the pieces to be physically cut into four or eight pieces, to achieve a smaller change.

Outside of the Spanish universal monarchy, it was very difficult to obtain Spanish silver coins with denominations less than those of the pieces of eight. Thus, the physical partition of the coin was the only way to obtain fractions and subsequently reseal them for use.

Many currencies, such as those of the countries that became independent in America, the Canadian dollar, the Chinese yuan, the Japanese yen, the Philippine peso, and others around the world, were initially based on the real de a ocho. This global acceptance was the origin of the symbol “$” that was used in account books all over the world, imitating in a simplified way the columns and bands that appeared in the original real de a ocho coin.

The relationship with the birth of the dollar

When the time came for the emancipation of the North American colonies, the brand new United States formally repudiated the British currency and found it necessary to mint their own currency.

The eight-dollar real then served as a model for the birth of the dollar and thus, the silver unit of the United States monetary system, created by the law of April 2, 1792. It was born based on the “piastra”, indigenous voice, with which the Mexicans referred to the Spanish real de a ocho.

In fact, in the beginning, US dollars were guaranteed with reales de a ocho. As an anecdote, we will say that until 1997 the custom in the US stock market of selling and buying shares in eighths was maintained, for the real de a ocho that was the guarantee currency when Wall Street began to operate.

The international prestige of the real de a ocho made it the only means of exchange in international trade to trade with the East and obtain tea, silks, or ivory. And when China issued its first silver coin, the tahel, in 1899, it did so on the Spanish model of the real de a ocho.

China: the empire’s best customer

The main silver producers worldwide were the Spanish Indies and Japan, not Europe; and China was the main destination market for silver. Japan also had an important production, but the Spanish empire led the market.

Thanks to the Manila Galleon, coins from Spain also arrived in large quantities in the Philippines, Asia’s great trading market. They did it in the galleons that from 1565 to 1813, made the Acapulco-Manila route and returned carrying the expensive porcelains and silks from China, along with spices and other luxury items from India, bound for the American and European markets.

Conservative official estimates indicate that Spanish America alone produced approximately 150,000 tons of silver between 1500 and 1800 (Barrett 1990, p. 237), perhaps exceeding 80% of the entire world’s production in this period of time.

It is known that from the Spanish Indies about five million pesos a year left to foreign kingdoms, from New Spain via Acapulco to China, from Paraguay to Brazil, or from the other Spanish domains through the many secret smuggling mines

Asia and even Africa were the destinations of the riches of our Indies because crossing the oceans they went to hide in the kingdoms of China, Japan, East India, Persia, Constantinople, Greater Cairo, and Barbary, and it is claimed that it hardly ran between those remote people other currency than pieces of eight and Castilian doubloons.

One of the main markets for this silver, in the form of eight real coins, was China and the Asian peoples, who accepted this coin for its intrinsic value. The Spanish brought thousands of tons of silver into China between the mid-16th and mid-17th centuries, which were added to the quantities of the same metal being imported from Japan.

This is how researchers Dennis O. Flynn and Arturo Girálde point out in their publication “Born with a ‘Silver Spoon’: The Origin of World Trade in 1571”:

The production and distribution of silver during modern times in the Western Hemisphere has been studied extensively, although the largest client in the world, at this time, which was China, has been systematically removed from the narrative. This is peculiar. China’s dominance as an importer of silver was critical at least during the birth of world trade. Godinho (1963, 1: 432-65) aptly described China as a “suction pump”, “a vacuum cleaner” that attracted silver on a world scale for centuries. The value of silver in Chinese territory was twice that of anywhere. This fact is reflected in the bimetallic estimates made by Chuan. From 1592 until the early seventeenth century, gold was exchanged for silver in Canton at a rate of 1: 5.5 to 1: 7, while in Spain the exchange rate was 1: 12.5 to 1:14, a question that indicated that the value silver was twice as high in China as in Spain. These divergent bimetallic figures created enormous prospects for a very profitable trade, since the exotic products of China were bought for very low prices compared to those of sale in Europe, given the great silver value of our currency for the Chinese.

Of course, with time, inflation also came:

Such massive infusions of silver diminished the purchasing power of the metal. Silver, like any item, lost its high value when supply exceeded usual demand. This in turn affected the prices of almost everything in the Empire, because the price structure was tied to the value of silver.

The metal had become more abundant and its purchasing power diminished. This inflationary trend affected the value of all raw materials, since everything had been valued in silver and silver had lost its value. If the silver lost value, more money was needed to buy the items that had kept it.

In the long run, this would cause the decline of both economies, which did not contemplate specific contingencies that would counter the stagnation of demand.

Pattern for the rest of the coins

In any case, the truth is that millions of pieces of eight were minted over several centuries. They were not only widely used during the colonial period in the Americas, but also in Africa and Asia well into the 19th century. The coins were often stamped with foreign characters to make them appear legal tender in many countries around the world, as can be seen in the samples below.

In short, the unit of world trade up to the 19th century was the piece of eight, which preceded the British gold pound sterling and the US silver dollar in their global financial hegemony.

The slow end of the real de a ocho

In Spanish America, the circulation of the eal de a ocho exceeded the colonial period of Spanish rule and minting in the “ceca” (mint) of Mexico, the only one authorized. The royalists created provisional mints in Chihuahua, Durango, Guadalajara, Guanajuato, Sombrerete, Zacatecas, Oaxaca, Valladolid, Real del Catorce and Monclova.

With the end of the Hispanic Empire, the real maintained its competitive power and was the reserve currency that was treasured in China, India, and the Middle East. The real de a ocho real was still the most universal currency in the mid-nineteenth century and even at the end of the nineteenth century, the role played by the eight-dollar real was notorious in the East.

It maintained its undisputed authority against other strongly emerging silver units, such as the US dollar, the Japanese yen, the Austrian thaler, the French piastra, the Indian rupee, the British silver shilling and it would prevail as a reserve currency in China, India and the Middle Eastern States.

So widespread was the influence of the real de a ocho that an estimated one-third of the world’s population lives today in countries with named or originally created currencies based on the model of that single currency.

The British pound outperformed the real of eight as a Western benchmark currency for part of the 19th century through the mid-20th century. However, even though the British Empire was the dominant power in that period, the English had to swallow their pride in the negotiations with the countries of the East.

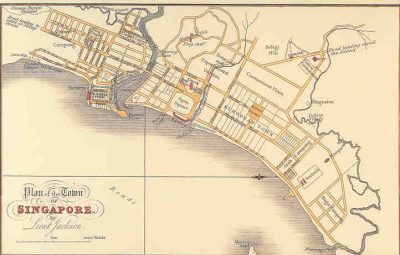

The purchase of Singapore in reals of eight

Thus, for example, the case of Singapore is illustrative. In 1918 Thomas Stamford Raffles was commissioned by the British government to negotiate a free port for the empire in the south of the Malay Peninsula.

In 1819 the agreement was reached that turned Singapore into a British free port, in exchange for the annual payment to the local authorities of eight thousand “Spanish dollars -8,000 Sp $”.

During the first year, the income from the trade was around 400,000 Sp$. In 1821 the population of the island increased by 5000 inhabitants and the volume of trade was 8 million Sp$. The population exceeded 10 000 inhabitants in 1825, handling figures of 22 million Sp$. In 1823, Raffles signed a second treaty, which extended the possession of the British Empire on the island, in exchange for the delivery to the authorities of 2,300 Sp$ per month for life.

On the other hand, the Americans, who knew the real de a ocho as the “Spanish Dollar”, gave such importance to that currency that they forever adopted the very Spanish symbol of the Columns of Hercules (engraved on it), as a symbol of their current currency.

While in circulation in the United States, the real of eight was worth the same as a dollar. As mentioned, the price of the shares on the United States stock market was denominated in eights of a dollar until June 24, 1997.

The US dollar replaced the British pound as the world reserve currency at the end of World War II, in July 1944, at the Bretton Woods Conference held in the United States.

Wall Street, where until 1997 shares were valued at eighths of a dollar, the legacy of the Real de a ocho

The dollar is the most important reserve currency today, more than 50% of the total sum of international reserves are in dollars. For this reason, the US dollar is considered to have reserve currency status, allowing the United States to run larger trade deficits with limited economic impact as long as the largest foreign holders of dollars continue to accumulate them.

The euro is currently the second most commonly used currency in international reserves, with an approximate share of 27%, which places it as the second most important reserve currency after the US dollar.

But it was the real de a ocho of Spain that marked the way, lasted longer, and covered more territories. And it is time the story was told …

Share this article

On This Day

No Events

History of Spain

26 August 2020

27 January 2021

Communism: Now and Then

23 December 2022

28 July 2021